A Little Bird Told Me #1

The Restoration of the Wareham

On June 10, 2025, the Wareham requested $350,000 in public infrastructure funds, a 10 year total property tax abatement valued at $100,000, industrial revenue bonds increase from $25 million to $40 million, (REDACTED: technically yes, but it’s more complicated than that: see July 15 update below) and sales tax exemption on the new budget.

The Wareham had already received $25 million in industrial revenue bonds from the City in December 2023 (RESOLUTION NO. 120523-A). (REDACTED: My understanding of IRBs was also fundamentally flawed, see July 15 update below). Since then, their budget has exploded to $40 million as a result of purchasing more property, adding in 5 short term rentals, and adding extravagant details to the build. In the course of my investigation, I found many parts of their business plan to be fundamentally flawed. In this report, you’ll be able to review my findings and source documents in plain English and not buried in a 2+ hour video.

The Business Plan

Pre-pandemic numbers used. The Wareham’s business plan included tourism data for the state of Kansas, but no local data. Additionally, the study they reference is “Economic Impact of Tourism in Kansas: 2019.” I find pre-pandemic numbers for many businesses— but especially luxury spending and travel— to be largely irrelevant. The world has changed. More recent reports are available. The 2020, 2021, 2022, and 2023 reports are all published and available to the public, but these statistics were not cited.

Audience size inflated. The business plan relies on attendees from as far out as 90 minutes away, including Lawrence and Emporia. In my opinion, it is not a good business practice to assume that Lawrence residents would leave their own vibrant entertainment market for the Wareham, or favor a drive west to Manhattan over a much shorter drive east to Kansas City for entertainment. We simply cannot compete with Lawrence, Overland Park, and Kansas City venues. At the southern tip, it is also unreasonable to assume that Emporia residents would choose to drive to Manhattan when Wichita is the same distance away with much greater options.

Nevertheless, this business plan relies heavily on 60- and 90-minute drivetime populations to project attendance and income— a dangerous game for a $40 million facility.

Population growth exaggerated. Attendees from 60 and 90 minutes away pads potential attendee statistics. Projected growth over 5 years (2022-2027) are:

Manhattan: +493

30 minute: +764

60 minute: +1,707

90 minute: +6,723

Where are people with disposable income? Not here. The further away from the Wareham you get, the more likely a resident is to be able to afford a ticket. Wages here are projected to stagnate until at least 2027, according to the Wareham’s own business plan.

Can locals afford leisure? Wanting to understand the affordability of the Wareham for locals, I dug into local cities’ population, growth, and poverty rates. The results were not encouraging. The largest cities (Manhattan, Junction City, and Fort Riley) are largely shrinking. All three have a poverty rate above the national average of 11.1% (2023).

Sources:

Manhattan, Ogden, Fort Riley, St. George, Wamego, Belvue. Silver Lake, St. Mary’s, Junction City

An industry in decline. In this graph the center line (right underneath government) represents an industry that is stagnant— neither weak nor strong, neither growing nor declining. Entertainment is a large bubble, with lots of jobs, but the industry is rapidly shrinking. A large industry that is shrinking rapidly is a bubble, popping— like the housing market in 2008.

Unrealistic Projections. In the Wareham’s presentation, Mr. Mages presented the economic impact calculation on the left. The current sold-out venue capacity is 400 and the renovated sold-out venue capacity is 800. For the current capacity, it would take 100 sold-out events per year to reach the very bottom end of NIVA's high category. At the renovated capacity, it would take 50 events with both venues entirely sold out (approximately every weekend) to reach that category. However,

some of that seating is on balconies where patrons could not actually view the performances

neither of these estimates leave room for events that need to be cancelled due to inclement weather, performer illness/delay, or unavailability of the venue due to private events

When I suggested the medium category of annual patrons, Mr. Mages suggested that the tool was built for venues that only offer music performances. “Our programming will span performing arts, film, comedy, civic programming, academic performance, and other cultural offerings beyond traditional live music,” he said. Because the programming is more diverse, Mr. Mages said that the category should be higher.

I disagree. A wider range of programming does not change these fixed variables, which I find to be more of a deciding factor than programming:

Venue capacity

Population within 30 minutes

That population’s overall decline

That population’s poverty rate (their ability to afford leisure)

I have emailed Dr. Selman, the creator of this calculator and Director of Arts Management at Colorado State University for his perspective. When he weighs in, I will update this article.

Business plan is already not viable. Mr. Mages claimed that the Wareham would be insolvent (a fancy business word for upside-down or having more debt than income) if he had to pay taxes. Unfortunately, the operating budget he presented was already unsustainable. Event venue profit margins across the US vary between 10% and 20%. Even without paying taxes, Mr. Mages shows a profit margin of only1.5%.

Scroedinger’s (Non?)Profit

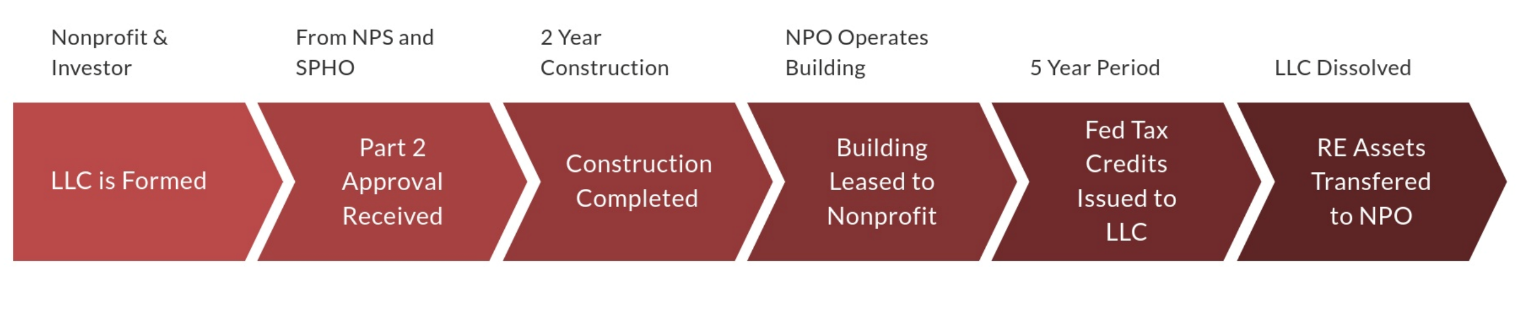

The Wareham wants to maximize the amount of tax incentives and public funds that it can get. To qualify for $4 million in Federal Historic Tax Credits, they must be a for-profit. But they also want to get grants and donations available only to non-profits— and to avoid paying property taxes.

In the Wareham’s plan is a complicated dance of for-profit and non-profit entities playing hot potato with the organization to essentially accept all of the benefits of being a for-profit and all of the benefits of being a non-profit at the same time.

Web of for-profit and non-profit organizations

Hot potato timeline

Request for Public Funds

The Wareham made two requests on June 10. The first was total— 100%— property tax abatement for 10 years, valued at approximately $100,000. This is a privilege of non-profits. 40% of the property in Manhattan city limits is already owned by non-profits and therefore not taxable. Usually, when the City approves property tax abatement, it is not for the entire value of the property, it is for improved value of the property. The Wareham’s request was not only unusual, but unusually high.

The second request was for $350,000 in public infrastructure improvements around the Wareham. This included building a tour bus stop in the alley behind the Wareham for musicians and charter buses; a dumpster space for the Wareham and nearby businesses; a more gradual rise into the building so musicians can roll their equipment in more easily, a decorative “walk of fame” sidewalk, and restructuring of street parking to accommodate a valet or drop-offs.

These changes raised some questions for me, some of which I posed during the meeting before my 3 minutes ran out, and some of which I asked Mr. Mages by email.:

Where will the displaced bicycle rack in front of the Wareham go?

I spoke to Mr. Mages, and a plan is not in place, meaning that relocating the bike rack has not been budgeted for.

How many events has the Wareham hosted in the past 12 months? How many are planned for the next 3 months? How many people have attended?

Although Mr. Mages championed the success of these events in his presentation as a reason for the public to be hopeful about future revenues, he declined to provide real statistics for past events on the grounds that the venue is not currently being run as a venue. As far as future events go, here is the Wareham’s website:

How does a private dumpster space benefit the public?

Mr. Mages claims that the dumpster will result in “less visual clutter, fewer odors, and less rodent activity.”

Will the bus stop be an ATA stop? Has the Wareham even spoken to ATA?

According to Mr. Mages, the stop will not be an ATA stop, as ATA believes the current location is safer for users of this public service.

How does a decorative sidewalk benefit the public?

Listen to my public comments:

How did the budget go from $25 million to $40 million in 18 months?

The Wareham’s plans ballooned dramatically. The Wareham bought an adjacent building which they also now intend to remodel. Building plans are also, in my opinion, extravagant, including:

Seating for 400 (800, standing room only, if additional egress can be developed)

3 bars: upstairs, downstairs, and main floor

3 lounges: upstairs, downstairs, and main floor

2 stages: main floor and downstairs

2 elevators, with a 3rd elevator just for a grand piano, not humans

Banquet hall upstairs

Upstairs prep kitchen

Downstairs full commercial kitchen

6 premium box seating areas

5 short term rentals

Spacious green room

Rooftop deck for Wareham office staff

5 doored offices

1 bullpen

Large conference room

Office breakroom

Breakroom for crew (separate from 3 dressing rooms), downstairs

Where do I stand on this issue?

As I said in my public comments, I am not entirely against the Wareham receiving tax abatement. However, the current plan does not meet Manhattan’s needs, or the core values I have outlined in my platform. Here’s how it measures up:

Data Driven, Human First

Manhattan and a 30 minute drive area cannot support a venue of this magnitude: we are shrinking and impoverished.

The 60 and 90 minute drive populations cannot be relied upon for consistent income

The industry is in decline, which makes it a risky investment

Mr. Mages plan to become a non-profit means that the City will not see a return on investment in terms of future property taxes

Needs over Wants

This project does not meet the basic needs of our residents

It is unfair to tax hungry residents and then turn those tax dollars into a grown-up playground that they can’t afford

Townies over Tourists

This is one of dozens of projects that have come before the City that is designed primarily to attract tourists, not to provide for our residents

Seek Sustainability

Restoration of the Wareham is much more sustainable than building an entirely new venue

However, the building specifications and budget are not sustainable

The annual operating budget is also not sustainable

My Verdict?

Many luxuries in Mr. Mages plan can be scaled back. In a $40 million project, $100,000 in property taxes to the City represent only 0.25% of the overall budget. City funds should be allocated to residents’ needs (not tourists’ wants) or to projects where future gains can be reasonably expected, which is not the case here. It is my position that Mr. Mages needs to scale back his wildest dreams into a more affordable build and his annual budget into a more viable business plan.

Update, July 15, 2025

This matter is on the Commission’s desk tonight at a legislative meeting. That means that the Commissioners will vote on whether or not to give these tax dollars to The Wareham. New documents have been provided to the Commission and to the public as a result. Here are my notes.

The Property Tax Abatement is Tied to Performance Metrics

Pros: The property tax abatement is tied to key performance indicators (KPI’s), namely the minimum investment, the annual ticketed patrons, and the Wareham’s ability to attract a percentage of its patrons from outside the community (more than 25 miles away from the community). It’s not just 100% straight out of the gates. Ticketed patrons cannot include the guests of private events, like weddings, business networking, and other rentals of the facility.

Cons: There is no clarity on what happens if one or two of the metrics fail to reach the board. For example, if year 1 shows $30 million invested, with proof of17,000 ticketed patrons, but only 8% are non-local, the agreement is unclear if The Wareham qualifies for any tax abatement that year. There is no qualifier in the definition of “ticketed patrons” to say that those tickets must have a cash value— potentially allowing the Wareham to pad numbers with online sales of free events. Full credit is given at a $33 million investment, not the $40 million project total.

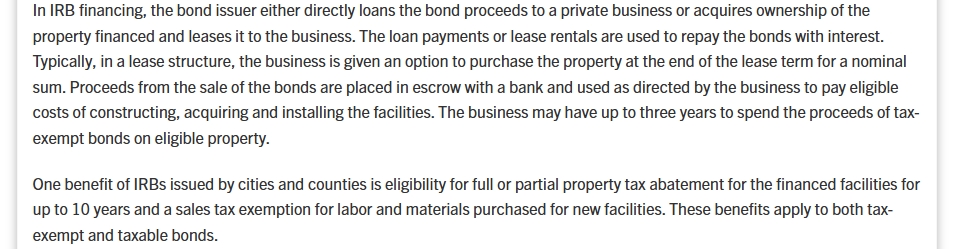

Are the bonds a loan?

Usually yes, but this parts gets weird. The Kansas Department of Commerce references the issuance of bonds as a tool that allows cities to take on debt:

Source for both clippings: Kansas Department of Commerce

The City of Manhattan approaches industrial revenue bonds differently: the City solely leverages these bonds as a way to unlock the associated property tax benefits, without selling any bonds or loaning money to the organization. City Manager, Danielle Dulin, writes,

“The city has not issued any industrial revenue bonds (IRB) for the Wareham project, and the city does not intend to issue any IRBs. The city has not participated in the issuance of debt or financing for a project in over 10 years, and in those instances, the city was only the conduit for a rate of financing from a private party. The city did not issue debt or financing.

“The IRB tool is used to leverage a sales tax exemption and/or property tax abatement with no debt or financial burden to the City. Generally, 40-50% of total project costs are eligible for sales tax exemption. For a $40 million project, it is anticipated that $20,000,000 is exempt from sales tax. That is approximately $1.83 million total savings for the project. The city’s portion of that would be approximately $366,000.”

Enormous thanks to Ms. Dulin for her explanation and apologies to anyone whose confusion was perpetuated by my own. Thanks, too, to Wareham Board Member and perennial volunteer of many worthy causes, Jeff Sackrider, who assisted my research.

Cost and Benefits

Source: Wareham’s Cost Benefit Analysis

I haven’t had a chance to dig into this section. I will be able to review it before the meeting tonight but won’t have an opportunity to update this article before the meeting, because my work week is slammed. I did think it was valuable to highlight and link to, so you don’t have to dig.

My Prediction

These tax breaks are going to pass tonight, likely in a unanimous vote. City staff have already negotiated with the Wareham, whose Board contains some of the wealthiest and most powerful men in town— men who get what they want.

From my observations over the past year, “convincing” the City Commissioners is the last and least important step in establishing projects and passing resolutions, and is little more than a formality. Everything has already been decided.

Another property that was once a tax-paying for-profit will be added to the over 40% of property in Manhattan city limits that is not taxable; this entity and the contractors who build it will not have to pay sales tax for this project of leisure— even while Manhattan’s residents pay sales tax on the necessity of groceries and 30+ year residents on fixed incomes are being taxed out of their homes.

This sickening reality is why I chose to run for office, and why I hope that our residents will vote for change at the ballot box this year.

Something has to give, and our residents already give too much.

Final Update, July 16

NIVA Calculator & Dr. Seman

I was able to speak to Dr. Seman today, July 16th, at lunch. He said that the venue tool is limited in what it can do for venues that offer more than just music, so it wouldn’t be overly optimistic to hope that the venue can bring in 40,000 patrons annually, especially if it is staying busy throughout the week. Leveraged properly, and with a diverse range of attractions on stage, the inclusion of the multiple stages and commercial kitchens will help the venue to reach those numbers. The ticketed patron numbers I found to be out of reach are attainable with consistent hard work— fantastic news for the Wareham’s outlook.

Dr. Seman was taken aback at our poverty rate. He mentioned that venues in impoverished areas can reach disadvantaged populations if they make it a priority. He gave examples of partnerships between the venue, public schools, and universities who work together to offer scholarships for students in various settings: after-school programs, in-house productions for youth artists, and summer camps. In this way, taxpayers who cannot afford to add live entertainment to their household budget— like many of my neighbors in Northview— will actually get to see the inside of the Wareham after its renovation is complete.

Public Hearing

At the Commission Meeting last night, Mr. Mages and City Staff did a much more thorough job explaining the Wareham’s ask, the structure of the organization, and the actual costs and benefits of his proposal— while leaving behind the less realistic parts of the business plan. This streamlined approach allowed the proposal to really shine. We lose $100,000 in property taxes and $366,000 in sales tax to get $4-6 million in federal funds. As Tom Addair so eloquently put it, “Why in the world would we not do that?”

The Wareham’s supporters came out in mass. It was really inspiring to see, and soothed some of my concerns that the venue wouldn’t have enough local audience to stay afloat. Although runaway inflation, upcoming tariffs, mass federal employee layoffs, and the resulting ripple effects at K State and in our local economy will certainly present challenges to the fledgling non-profit, they stand a real chance at longevity if they can maintain such an impressive level of community support.

As I did in the July 15 update, I want to again sincerely apologize for my misunderstanding of the structure and application of Industrial Revenue Bonds (IRBs) and to thank Board Member Jeff Sackrider and City Manager Danielle Dulin for helping me to understand how the Wareham’s ask— and Manhattan’s use of the bonds— differs from the information available from the State of Kansas.

With the new information, let’s reassess the core value measuring stick

Data Driven, Human First. The addition of performance metrics puts the data into the driver’s seat. If the venue can’t perform to minimum on one metric, they do not get the abatement, which seems harsh but it’s why the metrics are more forgiving in earlier years and why the full $40 million is not a requirement to hit 100%. It’s built to set up the Wareham’s team for success while also putting away the rubber stamp.

Needs over Wants. Although Abraham Maslow does not directly define an arts venue as a need, the project will fill the refrigerators of the construction professionals, venue staff, and downtown employees with help from an influx of federal dollars— including my neighbors in Northview.

Townies over Tourists. The Townies showed up and spoke up: they want this, they’re willing to support it come heck or high water, and whether it brings in the tourists or not, the Wareham is for the townies.

Seek Sustainability. Restoring an historic building is considerably more sustainable than building new. The Wareham’s budget is unsustainable, as most non-profits are, but their supporters are willing to make up the difference, when needed. The report from Dr. Seman was promising, showing that the Wareham may not need as much from their donors once the doors are open. The decorative sidewalk was removed from the discussion, although infrastructure improvements in the alley remained. From City Manager, Danielle Dulin, “The annual expense for the city to maintain a sidewalk is negligible. However, the concern is what it will cost to replace the sidewalk when the time comes. This could be 40-50 years from now, or it could be sooner if there is a water line break, or some other unexpected failure.” Tabling that perfects the sustainability score of the proposal.

That’s 4/4, A+, 100%, so I used my time at the podium (video link at 1:13:18) to thank Mr. Mages for his time and efforts to address my concerns and clear up my confusion about IRBs and to congratulate the Wareham’s donors and cheerleaders on their incredible show of support.

I also asked the Commissioners to consider their spending habits and what that could mean for Manhattan’s future. With cuts to education, after-school programs, SNAP, Medicaid, the USDA and more, the City will also have to pick up the weight that federal funding cuts will continue to stack up onto already-strained non-profits.

Epilogue

Not an hour after the City Commission decided to forego this $366,000 in sales tax, they had a spirited discussion on how shortfalls in the collection of taxes from people who are unable or unwilling to pay (called “delinquency”) caused the City to withdraw $368,000 from the general fund to pay RCPD’s contracted rate in 2024. And I have to be honest, it gave me a little whiplash.

This is not a question of the Wareham’s request— especially considering the broader benefits associated with it— but it does resonate with my overall discomfort around the inconsistency of the Commission’s budgeting practices.

I remember last year, when the Commission was deeply considering laying off up to 70 City staff members and cutting services to the public to make up for a dwindling general fund, and in 2022 when Former Mayor Wynn Butler proposed cutting social services altogether as a cost-saving strategy.

On June 19th, I requested a list of the projects that the City has funded through property tax abatement, sales tax abatement, and other means from 2023 to the present. I think it will be valuable to know

how much we have lost in taxes that we decided not to collect,

how much we hope to gain in future taxes as a result, and

what will happen to the budget in the meantime.

They said it would be ready in a “July/August” timeframe, so hold tight and we will dig into the numbers when we arrive.